Guides

5 Killer Financial Advisor Marketing Strategies Built For Success

Marketing can be a daunting task, but it is essential for financial advisors who want to grow their business. Finding the right marketing strategy can be challenging, and it could take a lot of trial and error before finding one that works. It can also be time-consuming and expensive when one uses various marketing tactics without a clear plan.

If you’re a financial advisor looking to improve your marketing game, or you’re just starting, the good news is that there are effective marketing strategies out there that can help you achieve your goals. In this blog post, we detail five killer financial advisor marketing strategies that have been proven to work, so let’s dive in.

Paid Advertising: Financial Advisor

Paid advertising is an excellent way to get your financial advisory services in front of potential clients. Whether you opt for Google ads or social media ads like Facebook, Instagram, or LinkedIn ads, the goal is to drive traffic to your website, increase brand recognition, and generate leads.

One of the best things about paid advertising is that it’s easy to track, so you can see which ads are performing best and adjust your efforts accordingly. You can also target specific demographics, interests, and locations, making it a highly targeted and effective marketing strategy.

Influencer Marketing

Influencer marketing may not be the first thing that comes to mind when you think of financial advisor marketing, but it can be incredibly effective. Partnering with influencers in your niche can help you reach a wider audience and breed trust with potential clients.

To get started with influencer marketing, look for social media influencers in your industry that have large followings. Make sure their audience aligns with your target market before contacting them to collaborate. Some successful influencer marketing strategies can be hosting webinars together or guest posting on each other’s platforms.

Social Media Marketing

Social media marketing is a must for financial advisors in today’s digital age. With almost 3.5 billion active social media users, there’s a high chance that your target audience is on at least one of the social channels.

To go about social media marketing as a financial advisor, there are two critical things you need to do; provide value in your content and be consistent in your posting. Social media is used to engage with your clients and build relationships, share valuable finance information, strengthen your brand and reputation for attracting new prospects.

Performance metrics such as shares, likes, comments, and link clicks are essential to monitor, so pay attention to the numbers and adjust your strategy as needed.

YouTube Marketing

Video marketing on YouTube has become an increasingly popular marketing tactic for financial advisors. High-quality, informative videos can help you gain credibility in your niche while providing valuable information to potential clients.

To stand out on YouTube, you need to create top-quality videos with clear messages; to get started, consider using explainer videos on different financial aspects like investing, savings, or retirement.

If you’re not confident with producing video content, partnering with video production professionals can be a good idea. But even then, high-quality content and strategic approaches in title, video description, and use of directions and tags can lead to substantial success in your YouTube marketing.

Search Engine Optimization (SEO): Financial Advisor

Lastly, search engine optimization is a long-term investment that pays off over time, and it’s an essential part of any financial advisor marketing strategy. SEO involves optimizing your website and content so that it ranks high in search engine results pages.

It’s a slow process and requires patience, but staying committed to the right on-page optimization practices and link-building strategies will generate a consistent source of organic traffic over time.

Sales Funnels: The Best Way to Sell Your Services Online

Are you tired of driving traffic directly to your website or sales page without converting them into clients? This is a common mistake that most online marketers make while trying to grow their businesses. However, if you’re a financial advisor wanting to make a difference in your client’s lives, you need an effective method that builds trust and credibility while showcasing your value. In this blog post, we’ll explain why sales funnels are the best way to sell your services online and how to implement them correctly.

First off, let’s clarify what exactly a sales funnel is. It’s a sales process that guides potential customers through a series of steps to convert them into paying clients. The goal is to build rapport, establish trust, and provide value at each step of the process. An effective funnel begins with a lead magnet, which is an incentive or free offer that attracts potential clients. Once they opt-in with their contact information, you can nurture the relationship through an email series that educates and builds credibility. The final step is to present your offer and convert them into clients.

So why are sales funnels the best way to sell your services online? The answer lies in their ability to build relationships and trust over time. Instead of pitching your services to cold traffic, you’re nurturing leads and building credibility with them. This process increases the likelihood that they will become loyal clients who refer you to friends and family.

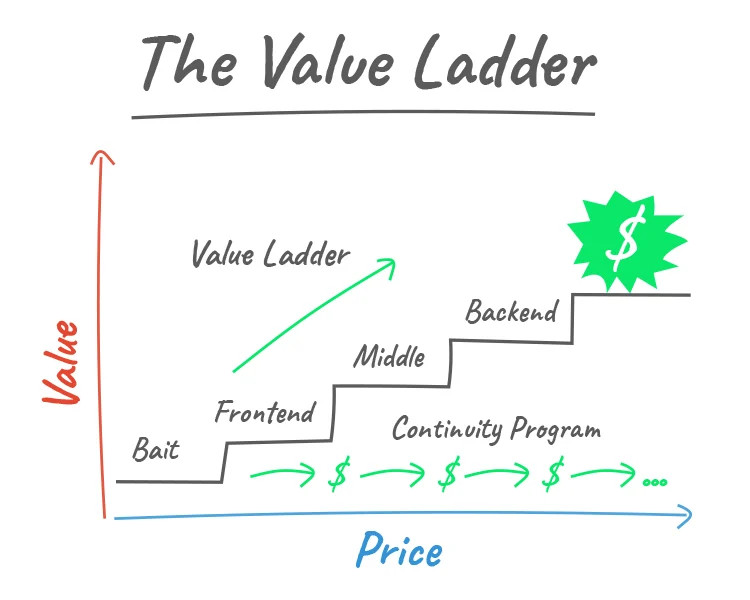

Now you might be thinking, which sales funnel model should you use to grow your business? While there are several models, we recommend the Value Ladder. This model focuses on providing value at different price points, with each level leading naturally to the next. For example, you might offer a free consultation or low-ticket service as a lead magnet. Once they become familiar with your services and see your value, they are more likely to invest in a higher-priced service or ongoing program.

Another benefit of the Value Ladder is the ability to upsell and cross-sell your existing clients. By adding value through additional services or products, you can increase the lifetime value of each client and foster loyalty. This approach also helps you differentiate yourself from competitors by providing a unique and customized experience.

Implementing a sales funnel does require some upfront work, but the payoff is worth it. By automating the process, you can focus on serving your existing clients and growing your business. You’ll also have a steady stream of qualified leads interested in your services.

Marketing your financial advisory business requires you to be strategic, adaptive and always improving. The marketing strategies mentioned above are some of the most effective ways to generate leads, build relationships with clients, and grow your business.

However, it’s worth noting that what works well for one advisor may not work for you, but the key is to try and refine as you progress. With the help of your marketing toolbox, you can start building your brand, gaining more industry recognition, and growing your clients base – before you know it, you can become a force to be reckoned with in the world of finance.

>>>Join The One Funnel Away Challenge<<<